TAKEAWAYS: Shaping the Future of the Global Supply Chain

From shipper expectations for the last quarter of 2023 to a regulations roundup, here’s how companies can navigate the peak season and keep freight moving while limiting costs.

Shippers Share High Hopes

What are shipper expectations for Q4—traditionally the busiest shipping season of the year? The latest BlueGrace Logistics Confidence Index finds:

- Expected revenue growth. Positive responses increased, indicating most shippers (64%) are optimistic about revenue growth in the fourth quarter of 2023.

- Impact on inventory levels. Responses reveal a nuanced view of shippers’ outlook on inventory levels. Although a slightly larger portion compared to Q3 anticipates revenue fluctuations negatively affecting inventory, the majority still foresees a positive impact. This mix of perspectives suggests a dynamic marketplace where adaptability will be key.

- Order sentiment. A noteworthy finding shows the unprecedented level of neutral responses at 66% regarding order sentiment. This high level of uncertainty hints at an equilibrium between expansion and contraction, implying that most shippers are adopting a cautious approach, likely influenced by prevailing market ambiguities.

- Consensus. The Q4 data reveals a remarkable alignment among shippers in terms of revenue, inventory, and orders. This convergence, not seen in more than one year, showcases a unified perspective within the industry and signifies that stakeholders have identified common ground and expectations for the upcoming quarter.

Shipment Volumes and Peak Season: What to Expect

Facing a complex international scenario of inflationary pressure and high interest rates, there is a ton of speculation around the effects of the 2023 peak season, with global stocks signaling caution and reflecting a slower pace of replenishment.

The cycle of shipments and restocking for 2023 will be very similar to 2022, when the peak season did not increase the respective volumes, experts predict.

“It is expected that the rising interest rates around the world, except in Japan, will make inventory replenishment and shipping less necessary,” says Mario Veraldo, CEO MTM Logix, a logistics company. “However, unlike 2022, when rates were reduced during the high season, there is an expectation that rates will have a small increase this year.”

Veraldo attributes this recovery to global increases in specific product categories, reflecting a growing relationship in product categories in different geographical regions.

“These trends provide insights into current market dynamics, highlighting the importance of adaptability and strategic planning in a complex global market environment,” he notes. “The main challenge lies in the replenishment process in many sectors, which generally involves little data and relies heavily on intuitive ‘gut feelings’. This approach contributed to the whip effects experienced during the pandemic.”

The order book for container ships is at its highest ever, reflecting the restructuring of supply and demand in the sector. This aligns with the trends in global inventory figures, interest rates, and specific product category increases, all of which are influencing the current freight rate dynamics.

These trends suggest a scenario in which, unless the world economy grows and the movement of goods increases, freight rates could fall below pre-pandemic levels. This could lead to a scenario of prolonged deflation, Veraldo notes.

Yellow Went Under. Now What?

Now that Yellow Corp. is out of business, what can shippers do to keep freight moving while limiting costs?

With Yellow’s operations accounting for 9% of total U.S. LTL capacity, its collapse immediately tightened up the market. Other carriers are happy to keep former Yellow freight moving—for a price. Analysts say Yellow rates were 10-20% below competitors, and carriers are raising rates in the aftermath of the bankruptcy.

Pricing aside, carriers are also using the Yellow collapse to optimize the freight they move. If new loads from former Yellow customers are a better, more profitable fit for the carrier’s network than existing freight, they take action to purge less-desirable freight.

How? Mid-contract, out-of-cycle pricing actions. Shippers receive notice of a major rate increase or accessorial charge, and they have the choice to accept it or cancel their contract. An example of this tactic is a carrier changing their rules tariff on lightweight shipments. Carriers have a rule in their tariffs document called the “cubic capacity minimum” that applies an alternate rate or the standard rate—whichever is highest—to lightweight, low-density shipments of 750 cubic feet and greater that weigh 6 pounds per cubic foot or less.

For some carriers, the cubic capacity minimum now has been updated to apply to shipments of 350-750 cubic feet at 4 pounds per cubic foot—targeted to price out light, fluffy freight and smaller shipments. The shift makes shipments as small as three pallets eligible for the cubic capacity minimum, down from the previous 6 pallets threshold.

The cyclical nature of transportation supports the fundamentals for shippers: Build lasting relationships and maintain favorable contracts by upholding practices that make them a shipper of choice.

But careful analysis can also pay off. Identifying lane imbalances can allow shippers to capitalize on major differences among carriers that yield meaningful cost savings.

Success in today’s LTL market requires investing in the give-and-take of long-term carrier relationships and digging deep to capitalize on opportunities when market conditions work in their favor.

– Kevin Day, President, LTL, AFS Logistics

Taking a Hard Look at Drayage

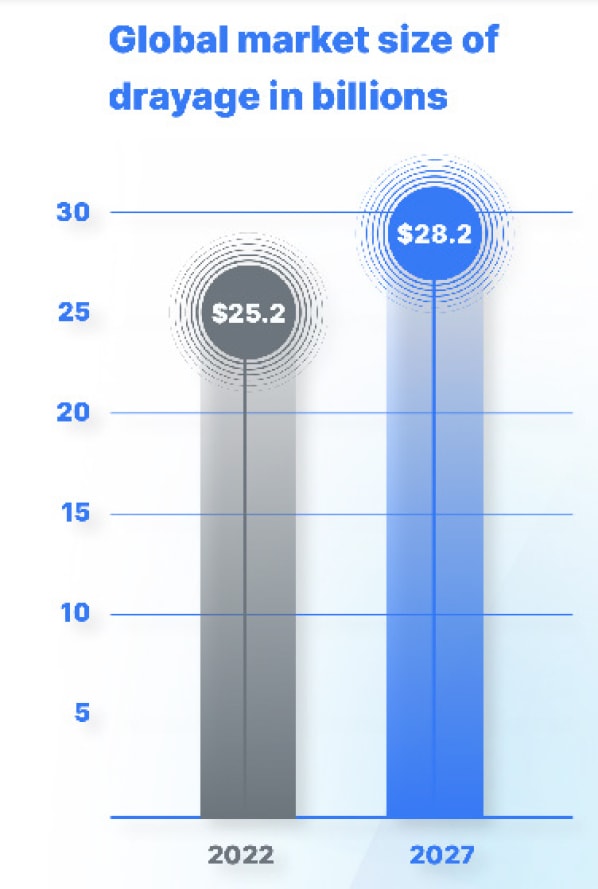

The U.S. drayage industry is poised to grow from $6.1 billion in 2022 to $8.3 billion by 2027. A new report from PortPro, a drayage software provider for drayage carriers, identifies the following trends:

The U.S. drayage industry is poised to grow from $6.1 billion in 2022 to $8.3 billion by 2027. A new report from PortPro, a drayage software provider for drayage carriers, identifies the following trends:

• Primary growth drivers come from a global increase in consumer demand for ecommerce. Areas to watch for more future growth include electronics, food and beverage, autos, chemicals, oil and gas, and pharmaceuticals.

• Drayage is at a technological crossroads. Growth-minded drayage carriers are adopting technology to digitize operations and improve efficiency and services.

• Increased investments to strengthen the infrastructure of the entire port ecosystem to accommodate growth in consumer spending and imports. Improvements to bridges, new equipment, new larger vessels, overall operation expansion, new technologies, and more employees impact all players.

• A sustainable future is top of mind, but slow in adoption. Carriers share concerns for building infrastructure to support e-fleets and other AI opportunities on the road and in warehouses.

Regulations Roundup

No matter what industry your company is in, you need to stay aware of relevant regulations and take steps to comply.

Here is a brief roundup of some major government agencies in the logistics and supply chain space and their current rules.

Federal Motor Carrier Safety Administration (FMCSA)

The FMCSA regulates commercial motor vehicle (CMV) safety in the United States. This includes regulations on securing cargo, driver hours of service, and vehicle maintenance. Recent FMCSA rules include:

- More frequent drug and alcohol testing for drivers. The FMCSA now requires truck drivers to be tested for drugs and alcohol at least once every two years, and more often if they have a positive test result or are involved in a crash.

- Electronic logging devices (ELDs). All commercial motor vehicles must be equipped with ELDs that track driver hours of service. This rule was originally implemented in 2017, but some exemptions expired in 2023.

- More efficient and effective safety fitness determinations. The FMCSA’s new safety fitness determination process focuses on identifying carriers that are most likely to pose a safety risk, and takes into account a wider range of factors, such as vehicle maintenance records and driver history.

- The safe introduction of automated driving systems (ADS). The FMCSA has published a notice of proposed rulemaking (NPRM) for ADS-equipped commercial motor vehicles. The NPRM seeks comment on several issues, including how to ensure that ADS-equipped CMVs are operated safely and how to address the liability implications of these vehicles.

Food and Drug Administration (FDA)

The Food and Drug Administration regulates the safety of food, drugs, and medical devices including how they are manufactured, transported and stored.

While there are no new transportation regulations specifically for 2023, the FDA’s key transportation regulations include:

- Hazard Analysis and Risk-Based Preventive Controls for Human Food rule. Requires food facilities to identify and control hazards that could cause foodborne illness, and to implement preventive controls to reduce the risk of these hazards.

- Sanitary Transportation of Human and Animal Food rule. Establishes sanitary practices for truckers and rail shippers, loaders, and receivers involved in transporting human and animal food to ensure its safety.

- Current Good Manufacturing Practice (cGMP) regulations for Finished Pharmaceuticals: Establishes requirements to ensure quality and safety during the manufacturing, processing, packaging, labeling, and holding of finished pharmaceuticals.

Environmental Protection Agency (EPA)

To reduce greenhouse gas emissions and air pollution from vehicles, the EPA has proposed several new transportation regulations for 2023, including:

- New fuel economy standards for light-duty vehicles. These standards would require light-duty vehicles such as cars and trucks to get an average of 55 miles per gallon by 2026, up from 40 miles per gallon in 2023.

- New emissions standards for heavy-duty vehicles. These standards would require heavy-duty vehicles such as trucks and buses to emit less nitrogen oxides and particulate matter.

- Renewable fuel standards. These standards would require a certain percentage of transportation fuel to come from renewable sources, such as corn ethanol and biodiesel.

- Proposed regulations on electric vehicles. These regulations could include requirements for automakers to sell a certain number of electric vehicles each year, or for utilities to provide charging infrastructure for electric vehicles.

Governing Bodies

Here are some other government agencies issuing regulations that may affect your supply chain and logistics operations:

Occupational Safety and Health Administration (OSHA) regulates workplace safety.

Customs and Border Protection (CBP) regulates the import and export of goods.

Department of Transportation (DOT) regulates the transportation of goods by air, land, and sea.

Securities and Exchange Commission (SEC) regulates the financial aspects of supply chain operations.